Nationally recognized Litigation Defense Firm

Our Firm

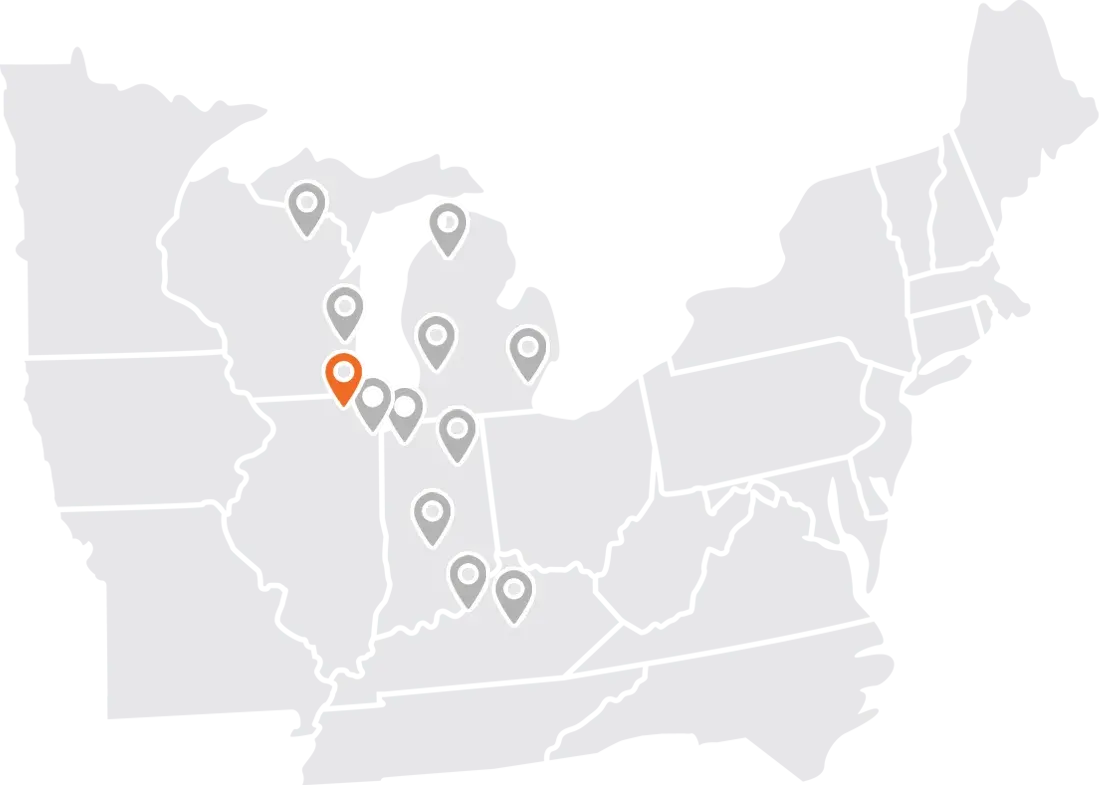

Kopka Pinkus Dolin is a regional law firm dedicated to the defense of litigated matters on behalf of corporations, municipalities, and insurance companies. Our firm represents clients throughout the Midwest on complex legal issues of automobile and trucking cases, municipal law, commercial litigation, fraud/SIU, insurance defense, employment law and EPLI, product liability, professional liability, restaurant & retail, workers’ compensation claims, and much more. Our dedicated attorneys have decades of experience trying large cases as well as resolving cases effectively without trial throughout our practice states.

Your Business Partners / Your Trusted Partners

KPD’s signature concierge service ensures that we build strong and diverse relationships nationwide. We are trusted partners to 100% of the Top 10 insurance companies in the United States, major transportation carriers, municipal governments, and nationally known restaurant and retail chains.

We also strive to be a great place to work, fostering a diverse and inclusive environment, earning us accolades from Top Workplaces, Top Places to Work, Gallagher Bassett, Martindale-Hubbell, Leaders in Law, Super Lawyers, and a RING certification (Recognizing Inclusion for the Next Generation). We are proud to have a culture that resonates with our employees as well as our clients.

Our Commitment

With offices in Illinois, Indiana, Kentucky, Michigan, and Wisconsin, we provide strategic, incisive advice and successful representation to companies throughout the Midwest. Our team of attorneys work side-by-side with you to assess a claim quickly and efficiently and prepare a defense to resolve or negotiate a favorable settlement. Our signature concierge service provides accessibility to a team of attorneys, consistent communication, and superior responsiveness, ensuring we are exceeding expectations on each case.

Our Innovation & Security

KPD is committed to deliver positive outcomes while keeping your confidential information safe. Our firm stays up to date on the latest technologies and innovations in litigation management to deliver better service to our clients. Using cloud-based systems has prepared us to be flexible and secure while creating accurate and customized data analytics for each client. We understand our firm’s reputation is directly linked to the way we secure, manage, and provide data and we are consistently safeguarding sensitive information and frequently updating our technology.